What Zillow, Compass, Homes.com—and most AI real estate tools—get wrong about how people actually buy and sell homes.

Real Estate Platforms Are Still Built for Browsing, Not Deciding

Scroll. Filter. Click. Repeat. That’s the dominant experience across today’s real estate platforms. They offer an endless stream of listings, floor plans, and photos—but leave consumers asking the same questions over and over:

Is this a good price?

Is that building better than this one?

What’s the difference between these two neighborhoods?

Despite the hype, real estate “AI” still can’t answer these questions. Why? Because it’s built on listings without context.

The Fundamental Problem: Listings Are Not Intelligence

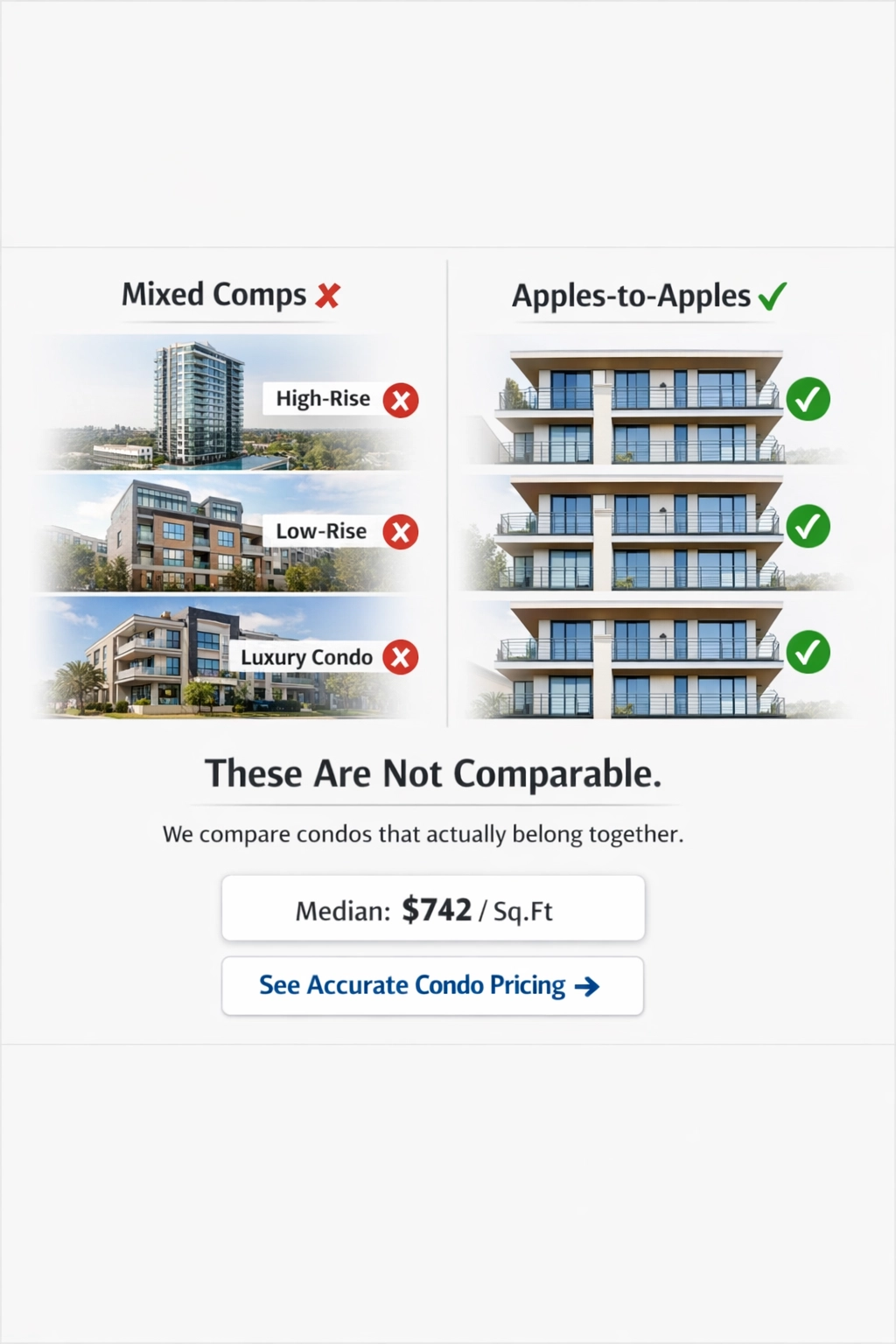

Every major platform—Zillow, Compass, Homes.com—relies on the same data foundation: MLS listings and public records. This data is excellent for showing what’s for sale. But it fails when a buyer or seller needs to understand the why behind pricing, demand, or value.

Listings give you facts: square footage, number of bedrooms, price per square foot.

But they don’t explain:

Why two nearly identical condos sell at different price points

Why one side of a street performs better than the other

Why two homes with the same specs yield very different results

In other words, they describe properties—not places.

Human Agents Still Win on Context

Ask any veteran agent, and they’ll give you real answers:

“That building has a stronger HOA.”

“This complex recently completed major upgrades.”

“That side of the community gets better water views.”

This kind of knowledge—community-level insight—can’t be pulled from a listing sheet. It comes from local experience, client feedback, and repeated exposure to how properties actually perform in real life.

AI can’t replicate this today because the data structure it’s built on is too flat. Listings are just cards in a feed. They don’t live inside a community framework.

Subdivision-Level Intelligence: What AI Has Been Missing

To build a truly intelligent real estate sidekick, platforms need more than property specs. They need a structured layer of place-based context—the kind only possible at the subdivision, condo complex, or micro-market level.

This means organizing listings not just by filters, but by real, named communities. It means seeing:

Median pricing and turnover within a single subdivision

How active inventory compares to recently sold units in the same community

Whether a listing is an outlier—or right on target

This is the level of intelligence buyers and sellers expect, but current platforms don’t deliver.

What We’re Building at Subdivisions.com

Subdivisions.com was built to fix this. We start not with listings, but with the places people actually care about—subdivisions, buildings, and neighborhoods that define lifestyle, rules, and pricing.

Every listing is attached to a real community. Every community is backed by data: pricing bands, days on market, HOA fees, flood zones, and more.

It’s not a prettier map. It’s a smarter way to think about search.

And it’s the only way to build real estate AI that actually helps consumers make faster, better decisions.

Comments